Bathroom renovation guide

If you are looking to complete a bathroom renovation in the near future here are 5 top tips you should keep in mind when renovating your bathroom:

- Know the bathroom renovation process (see below on – How to renovate a commercial bathroom)

- Know your design before you go ahead (link to great commercial bathroom designs)

- Research the trades you require- here is what to look for in a commercial tradesmen

- Get 3 fixed quotes – you want a minimum of 3 quotes to ensure your getting the best rate for your renovation but you need to make sure the specs and scope are identical from one quote to the next

- Manage the project without getting in the way- Keep communication open – processes and steps

How to renovate a commercial bathroom

To know the process of how to renovate a commercial bathroom, lets start it off with finding out what trades are required to renovate a bathroom before we get to the when you need them and a summary of the steps to renovating your commercial bathroom, not to mention some great tips on the way.

Trades required for a bathroom renovation

Depending on the type of work you are completing, you will typically require:

- A qualified plumber with a current license– for all your pipe work fittings

- A tiler – if you are having tiles, you want someone who is an expert in this field to avoid cracked tiles, uneven spacing, or an uneven job.

- A water-proofer – this is crucial as it creates the barrier between your property/ walls and any water also known as a membrane

- A builder – your property insurance will always require a qualified builder to oversea the build, this person builds the frames for your bath, shower and- if they don’t currently exist, your walls.

- A plasterer – a builder may lay the gyprock but it’s the plasterer’s job to smooth and prep it for painting

- A painter – Some painters can do both but you need to check as you want someone you know can do the job to high standard

- Cabinet maker – (if required)

- Vinyl layer (if laying Vinyl instead of tiling)

When renovating your commercial bathroom, you need to lock in several trades to make this possible. Each trade needs to be specialised in the job.

How to prepare for renovating a bathroom

- Choose your layout – configuring the layout or floor plan to make it work is key to a smooth process. There are programs out there that do this for you (click here to see a list) or your cabinet maker or architect can help with this.

- Research the materials you would like in your commercial bathroom and create a specs list for your key purchaser – usually your builder, commercial plumber or project manager – for organisations with multiple facilities that require identical material a specs list is quite handy to have. Otherwise you can leave it to your experts to choose the best products or design elements for the best price based on your layout and size requirements.

- Research your trades and hire the key project manager first– are you going with multiple companies or one company – read here for the benefits of both.

- Start your project- here is a guide on what order of bathroom renovation, time frames vary depending on the tradesmen, the equipment, budget and the size of the job

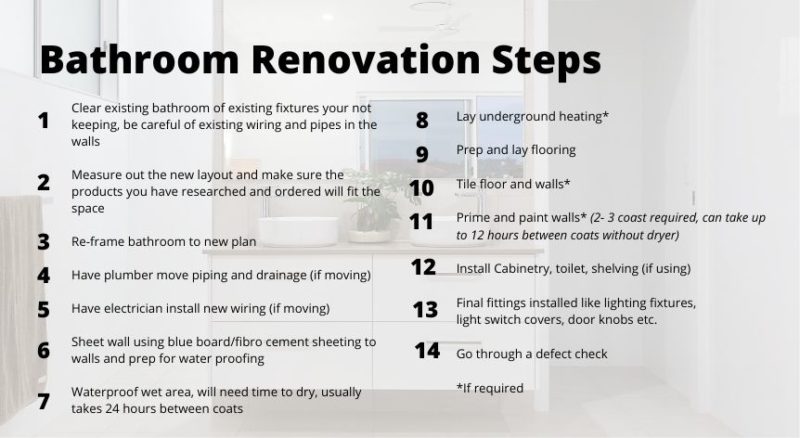

Bathroom Renovation Step by Step:

Who can do bathroom renovations?

While anyone that knows how to use a hammer can renovate and DIY’s are great for residential. For commercial renovations it is a requirement that qualified trades with a current license complete the things that can impact your insurances like pipe works, waterproofing and commercial electrical works etc.

Are bathroom renovations worth it?

The main reasons you would look to renovate is functionality, repair, or cosmetic. Perhaps you’re having a company re-brand or looking to upgrade the look and feel of your bathroom whatever the case, any renovation is worth doing if you have the time, budget and patience.

Are bathroom renovations tax deductible?

According to ATO Government site, regardless of whether you rent or own, whoever occupies the fit-out can claim it as a capital expense and either claim as depreciation or deduct as a “capital works deduction”. Either option means you won’t be able to claim it back straight away only at a percentage, generally 2% or 4% of the cost over the period of its life. But when you leave the premises and need to knock it down or “make good” you can bring forward the capital works and claim the residual value. If the fixture stays then the depreciation can be claimed by the new owners. You can view more on this here.

Hire Mathiou Services today!

Mathiou Services stands out for bathroom renovations due to our comprehensive approach and expertise. We ensure clients understand every aspect of the project. From plumbing to floor tiles, our focus on client involvement and informed decision-making, combined with our skilled trades professionals for each renovation aspect, makes us a reliable choice for your commercial bathroom renovations.